One of the best ways to improve your credit score is simply to pay your bills on time. This is absurdly simple but it works very well because nothing shows lenders that you take debts seriously as much as a history of paying promptly. Every lender wants to be paid in full and on time.

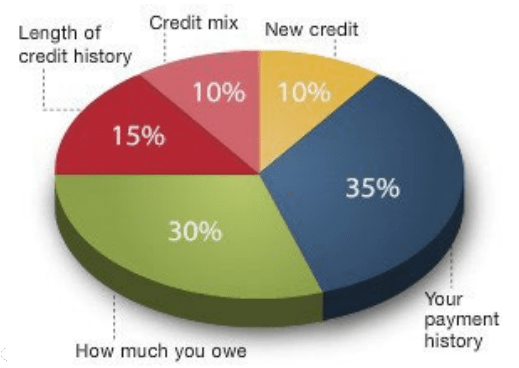

If you pay your bills on time then the odds are good that you will make the payments on a new debt on time, too, and that is certainly something every lender wants to see. Experts think that up to 35% of your credit score is based on your paying off bills on time, so this simple step is one of the easiest ways to boost your credit score.

Paying your bills on time also ensures that you don’t get hit with late fees and other financial penalties that make paying your bills off harder. Paying your bills in a timely way makes it easier to keep making payments on time.

Of course, if you have had problems making your payments on time in the past, your current credit score will reflect this. It will take a number of months of repaying your bills on time to improve your credit score again, but the effort will be well worth it when your credit risk rating rebounds!